Designing for Close-Knit Communities: Creating Informal Lending Functions for Venmo

Illustration by Sebastian Curi

The Team:

Danielle Stemper (me)

Sharron Lou

Tarun Venkatesan

We set out to understand, then design, digital features that would best accommodate informal lending.

We determined that close-knit communities need an informal lending design that takes values and emotions into consideration.

Working within a design frame – “build an app, website, or extended feature for managing and tracking informal lending and borrowing among close-knit communities.”

The solution? Venmo IOU.

The team designed extended features for Venmo for managing and tracking informal lending:

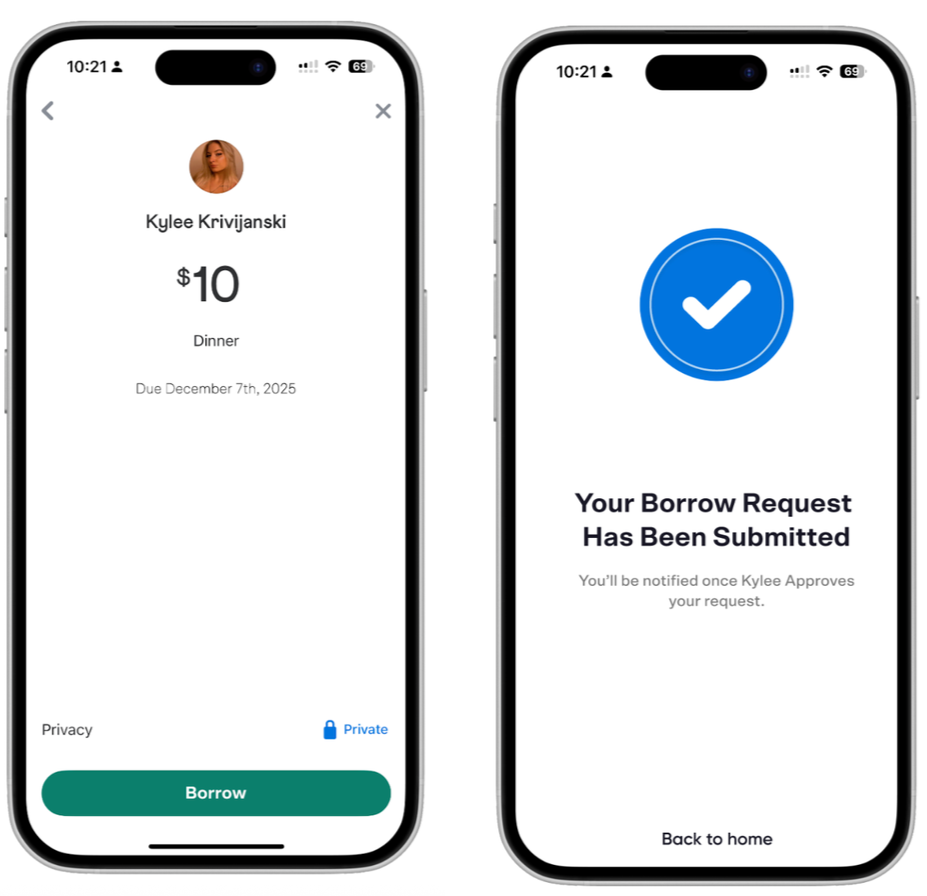

IOU Agreement System: Creates a simple, shared record of the loan so neither borrower or lender feels awkward or unsure about what was agreed upon.

Payment System: Makes repaying someone straightforward, relieving stress that comes with forgotten or late payments.

Reminder System: Gives friendly, low-pressure nudges to reduce some of the emotional weight from both lender and borrower.

Above: designs & animations by Sharron Lou

How did we do it?

Desk research to understand the dynamics and underlying emotional aspects around informal lending frameworks.

I was particularly interested in exploring topics such as the role of trust, the incentives of informal versus formal lending, and the use of financial technology (FinTech) and decentralized finance (DeFi). This research helped us realize that relationships, social capital, and technology needed to be major considerations in our design process.

Further, transparency and efficiency were two key values to incorporate at we ideated design concepts and features. Lastly, understanding the deterrents to informal lending was an important perspective to consider.

Ultimately, borrowers are more open to explore informal loan options when they’re comfortable with the process, and technology may help regulate this process.

Primary research conducting user interviews and collecting qualitative data from contextual observations. This included:

User interviews around participants’ experiences with lending and borrowing, as well as their perspective on the role of digital technology in personal finance, which revealed many insights around the emotions involved in lending.

Observations of a recreational league soccer team splitting costs for a night out helped deepen our understanding of the logistics around sending/receiving money within a close-knit group.

These were the recurring and themes related to lending that came up during interviews and field work: relationships, values, customs/habits, motivations, and de-motivations.

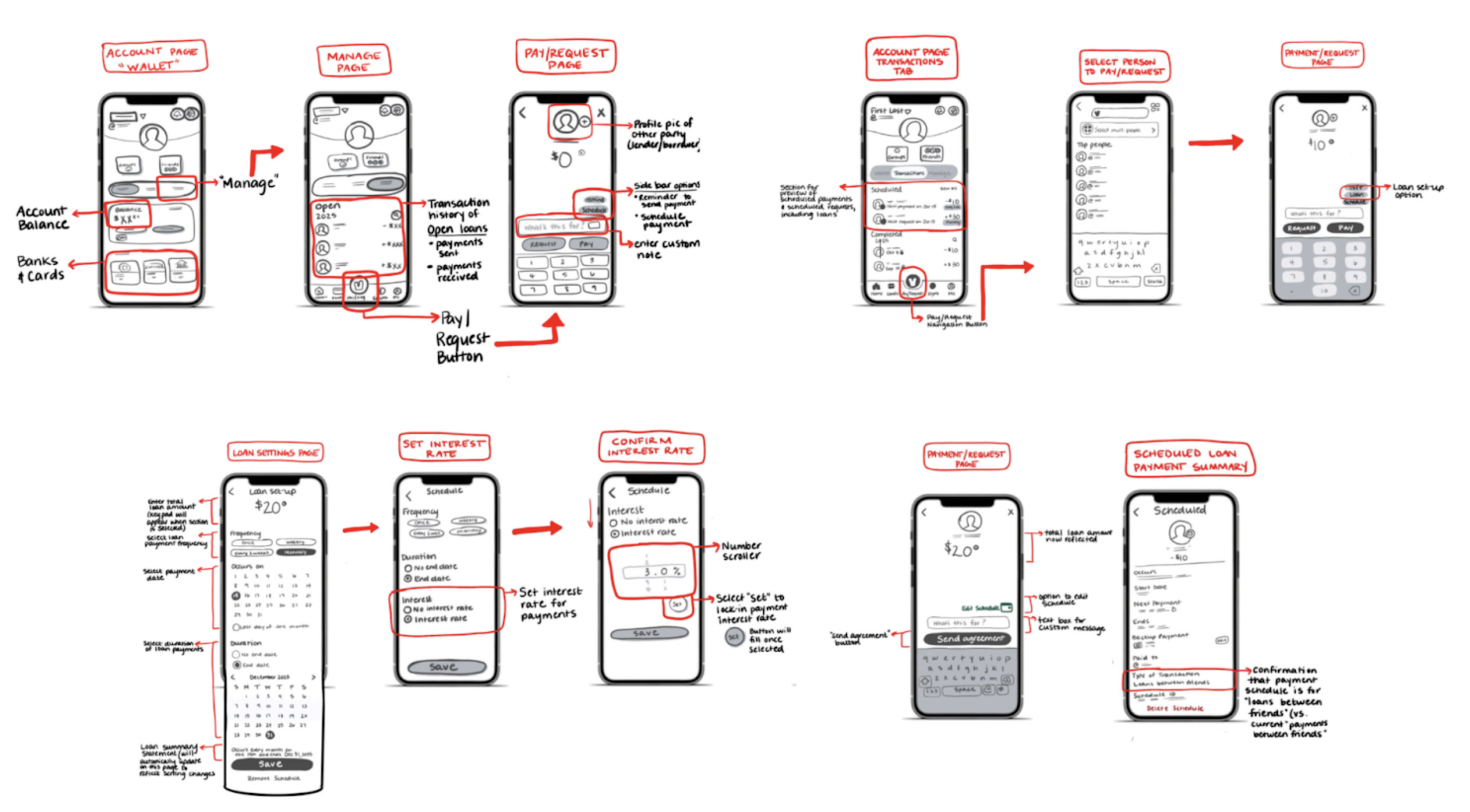

Conceptual development of design components through sketching and wireframe iterations that would ultimately inform our final prototypes

Above: my initial wireframe sketches mapping out potential IOU design concepts.

Above: my second iteration of wireframes mapping out potential IOU design concepts.

Engagement with designers throughout the process to gather initial comments and reactions, and run through ideas; ended with a presentation of the final product to a class of design students to receive feedback.

Key feedback:

Refine the reminder system with sensitivity to different relationship dynamics through increased customization options.

Explore potential mechanisms that encourage or enforce accountability around repayment.

More clearly distinguish the borrow/lend flow from the existing pay/request flow.

Above: the team’s printed design materials and conceptual frameworks arranged for a “gallery walk” to gather designer feedback.

Above: a snapshot of the live feedback we received from the design class to which we presented our final prototypes.

Results: a streamlined experience for informal lenders and borrowers.

Simplified money management

Users can track all peer-to-peer transactions in one place. The lending and borrowing extension is integrated seamlessly within Venmo’s existing interface.

Increased trust & transparency

Both lender and borrower can easily track repayment timelines, reducing misunderstandings.

Reduced friction between users

Features like pre-set deadlines, payment scheduling, and automated reminders make repayments smooth and prevent awkward follow-ups.

Reflection & key learnings

The influence of emotions and social dynamics throughout the users’ experiences is the common thread among informal lending.

In order to design effective functions, you have to think about the user’s experience beyond the application itself.

Social capital has a major influence on informal lending dynamics, and often dictates the terms of the agreement.

A holistic approach to design can help you think outside the box, but finding and leveraging the tools most relevant to your personal process is an essential aspect of being a good designer as well.